Claiming Dental Expense Tax Credit On Your Canadian Tax Return

Updated December 8, 2023

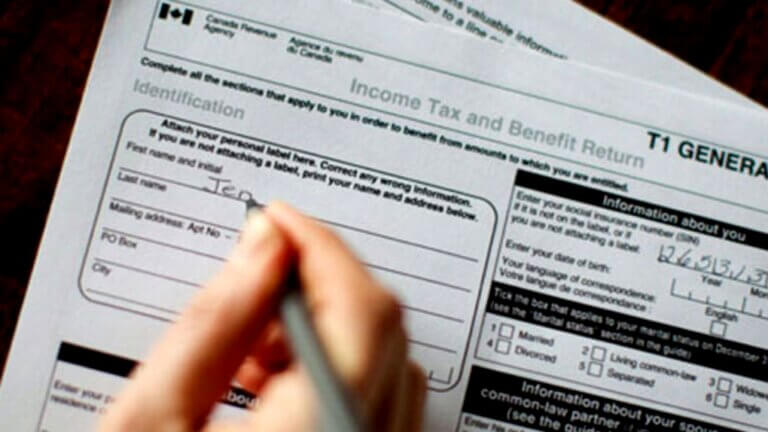

Did you know that you can potentially claim back some money from dental expenses on your T1 Personal Tax Return as a tax credit? Understanding what qualifies as eligible dental expenses, how to optimize the medical expense tax credit, and leveraging strategies to maximize your tax refund can make significant tax savings on household finances. Here’s an in-depth guide to making the most of your dental expenditures when filing your taxes in Canada:

- Eligible Dental Expenses For Tax Claims

- Calculating Your Tax Credit For Optimal Tax Savings

- Conclusion

If you have any further questions regarding dental insurance, payment options, or if you require assistance with the claims process or want to know more about the dental services offered at Atlas Dental, please contact us.

Eligible Dental Expenses For Tax Claims

The Canadian Revenue Agency (CRA) allows individuals to claim out-of-pocket dental expenses that are not covered by insurance. Most group insurance plans do not cover 100% of dental costs, therefore, it is imperative to consider claiming the portion of the cost that is not covered by insurance. Qualifying dental expenses generally cover a broad range of treatments essential for maintaining or improving oral health, including:

- Dental services: paid to a dentist or medical practitioner. Expenses for purely cosmetic procedures are not eligible.

- Dentures and dental implants: can be claimed without any certification or prescription.

- Orthodontic work: including Invisalign clear aligners and orthodontic braces paid to a medical practitioner or a dentist. Expenses for purely cosmetic procedures are not eligible.

- Premiums paid to private health services plans: including medical, dental, and hospitalization plans. They can be claimed as a medical/dental expense, as long as 90% or more of the premiums paid under the plan are for eligible medical expenses.

It’s crucial to recognize that not all dental expenses are eligible for the medical expense tax credit. Cosmetic procedures such as dental veneers and teeth whitening, performed primarily for aesthetic purposes, do not qualify. For a comprehensive list of eligible dental expenses, the CRA provides detailed information on its official website. You can refer to the CRA’s guidelines and list of eligible medical expenses through the following link: CRA’s Eligible Medical Expenses List.

Calculating Your Tax Credit For Optimal Tax Savings

Understanding how to optimize the medical expense tax credit can significantly impact your tax refund. You can claim out-of-pocket medical expenses for yourself, your spouse, and even your dependents. The amount you can claim is calculated using the following formula:

Your total out-of-pocket medical expense minus the lesser of

- 3% of your personal net income

or

- $2,479 in the year 2023 (this amount changes every year).

You can claim eligible medical expenses on line 33099 or line 33199 of your CRA T1 Personal Tax Return:

- Line 33099 – Medical expenses for self, spouse or common-law partner, and your dependant children under 18

- Use line 33099 to claim the total eligible medical expenses that you or your spouse or common-law partner paid for any of the following persons:

- yourself

- your spouse or common-law partner

- your or your spouse or common-law partner’s children who were under 18 years of age at the end of the tax year

- Line 33199 – Allowable amount of medical expenses for other dependants

- Use line 33199 to claim the part of eligible medical expenses that you or your spouse or common-law partner paid for any of the following persons who depended on you for support:

- your or your spouse or common-law partner’s children who were 18 years of age or older at the end of the tax year, or grandchildren

- your or your spouse or common-law partner’s parents, grand-parents, brothers, sisters, uncles, aunts, nephews, or nieces who were residents of Canada at any time in the year

Here are some key strategies to consider:

Spousal Income Thresholds

To maximize this benefit, the spouse with the lower income should consider claiming medical expenses on behalf of both spouses and dependents.

For example, Ben and Jenny are married and Ben makes $90,000 per year while Jenny makes $65,000 per year. The combined dental out-of-pocket expenses for themselves and their two children (net of what is covered by their dental insurance) is $4,500.

The amount of medical expenses Ben could claim on their behalf would be $2,021 ($4500 – lesser of ($2,479 or $2,700 (3% of $90,000)).

However, the amount of medical expenses Jenny could claim on their behalf would be $3,150 ($4500 – lesser of ($2,479 or $1,350 (3% of $45,000)).

Therefore, it would be more tax beneficial if Jenny, the lower income earning spouse, claimed the medical expense tax credit.

Claiming Period

You can select any 12-month period ending in the current taxation year to claim medical expenses.

For example if you incurred substantial dental expenses in December 2022 and again in February 2023, you have the flexibility to choose the 12 month period from December 2022 to November 2023 for claiming medical expenses for both expenses incurred in December 2022 and February 2023. Please note that you cannot claim the same expense more than once.

Keep Your Dental-Related Receipts And Invoices

Maintaining organized and comprehensive records of your dental-related receipts and invoices is crucial for accurate tax reporting and ensuring that you include all eligible expenses. But perhaps more importantly, these documents will be required in case the CRA decides to audit your T1 personal tax return.

Seek Professional Tax Advice

Navigating the complexities of the Canadian tax system is a daunting task and potential tax saving such as a credit for expensive dental procedures can easily be missed. Therefore, it may benefit you to seek guidance from a tax professional or accountant regarding your specific situation. They can provide personalized advice and ensure compliance with tax laws and regulations.

Conclusion

As you prepare to file your taxes, understanding the nuances of claiming dental expenses can significantly impact your tax return. By leveraging eligible dental expenses and employing strategic approaches such as optimizing expenses based on income and choosing the appropriate claiming period, you can optimize the tax tools available to you.

Remember, while claiming dental expenses can lead to tax savings, consulting with a professional ensures accuracy and compliance with current tax regulations. If you have any further questions regarding dental insurance, payment options, or if you require assistance with the claims process or want to know more about the dental services offered at Atlas Dental, please contact us.

About the Author:

Alice Choi CPA, CA, CFP: Meet our expert contributing author, Alice Choi, a seasoned professional in the world of finance and taxation. As a Certified Public Accountant (CPA), Chartered Accountant (CA), and Certified Financial Planner (CFP), Alice brings a wealth of knowledge and expertise to the intersection of personal finance and tax strategy.

We also think you’ll like…

Using Your Industrial Alliance Dental Insurance At The Dentist

Using Your Industrial Alliance Dental Insurance At The Dentist What Is Industrial Alliance Dental Insurance? Dental insurance is designed to help individuals and families manage

Using Your Green Shield Canada Dental Insurance At The Dentist

Using Your Green Shield Canada Dental Insurance At The Dentist What Is Green Shield Canada Dental Insurance? Dental insurance is designed to help individuals and

The Canada Dental Benefit: What Patients Need To Know

The Canada Dental Benefit Updated February 1, 2024 The interim Canada Dental Benefit is intended to help lower dental costs for eligible families earning less

Using Your Desjardins Dental Insurance At The Dentist

Using Your Desjardins Dental Insurance At The Dentist What Is Desjardins Dental Insurance? Dental insurance is designed to help individuals and families manage the expenses

Studentcare Dentist for Toronto Students

Studentcare Dentist for Toronto Students What Is Studentcare? If you’re a student seeking reliable and comprehensive dental coverage, look no further than Studentcare. Designed with

Free Dental Services For Refugees

Free Dental Services For Refugees If you are having a dental emergency and are eligible for the Canadian Federal Government’s Interim Federal Health Program (IFHP),